Long Term Care

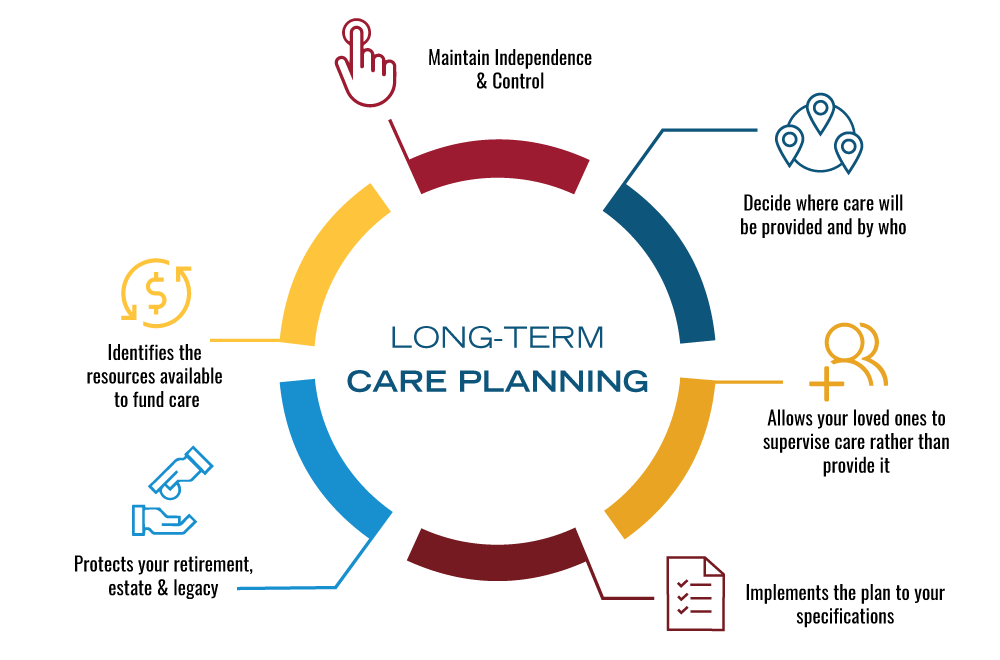

Long-Term Care and funding related future expenses is one of the most crucial planning opportunities for American workers yet it is often one of the most misunderstood and least discussed among clients and their financial advisors.

Our Long-Term Care Planning offerings are an integral part of your comprehensive financial

plan and can ensure tax benefits, plan funding, guaranteed cost certainty, and more.

We understand that there isn’t a one size fits all approach to funding Long-Term Care. Our plans are designed around your best interests and financial goals. Our Asset-Based solutions can create leverage using existing assets while still remaining liquid. We can help you decide if qualified money, life insurance cash value, annuities, monthly payments, or cash lump sums are most appropriate to fund your Long-Term Care needs.

Long-Term Care Solutions Include:

- Home Health Care

- Community Care

- Assisted Living Care

- Nursing Home Care

- Flexible Plan Design

- Social Security Planning

- Leverage assets while maintaining liquidity

- Medicare Planning